Social-Media

WhatsApp is finally starting to carry out payment systems in India

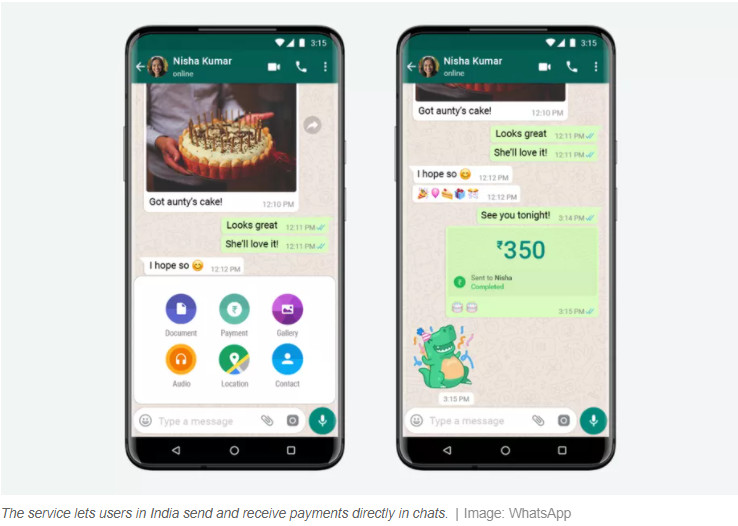

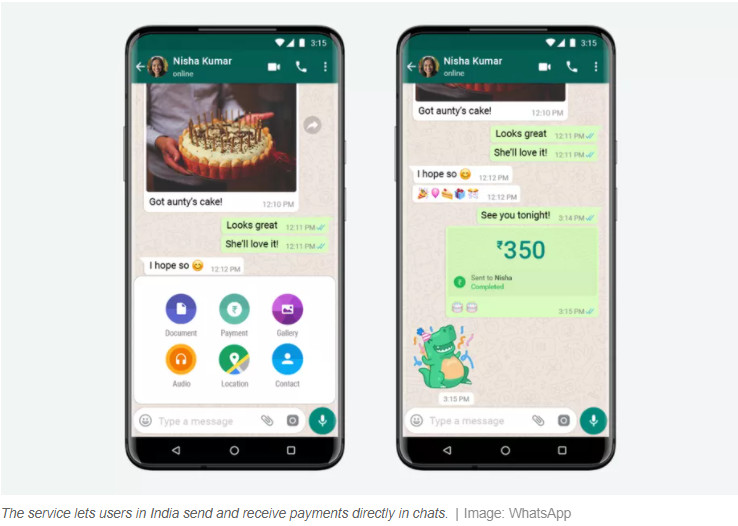

Facebook is launching its WhatsApp payment service for users in India after receiving approval from the country's regulators. The service was first introduced in India as a trial in 2018, but the initial roll-out was postponed for years due to data storage and sharing issues. It's a significant debut for WhatsApp's largest market, home to some 400 million people.

The Indian Retail Payments Regulatory Authority, the National Payments Corporation of India (NPCI), gave its permission to WhatsApp on Thursday, with Facebook announcing the roll-out of the service in a blog post. The news was important enough for Facebook CEO Mark Zuckerberg to make a video detailing some of his features.

"You will now be able to transfer money quickly to your friends and family via WhatsApp almost as easily as sending a tweet," Zuckerberg said. He also suggested that digital transfers were "highly significant" during the global pandemic, as they reduced the need for in-person cash exchange.

Watch | Mark Zuckerberg says, “Now you can send money to your friends and family through #WhatsApp as easily as sending a message."

— The Indian Express (@IndianExpress) November 6, 2020

Read here: https://t.co/Q9AQFbw3Lt pic.twitter.com/OcrNXQmGaw

WhatsApp's payment system can use India's national payment platform, known as the Unified Payments Interface or UPI. This facilitates interoperability between multiple applications and is also used by Walmart's PhonePe and Google Pay, two of the country's biggest UPI mobile payment services, each holding about 40% of the market.

Yet digital payment providers in India will face new obstacles in the coming months. As reported by TechCrunch, NPCI has announced this week that every one service would handle "[protect] the UPI ecosystem" will be limited by the sum of UPI transactions. In the future, no one service would be allowed to process more than 30% of the overall volume of UPI transactions, although it is not clear how these restrictions would be applied.

WhatsApp will take a while to meet these restrictions, but the NPCI has made it known that it will reel in the Facebook-owned payment service from the get-go. The regulator announced that WhatsApp will only be able to launch the service in a "graded" way, beginning with a "maximum registered user base" of 20 million UPI users.

In a blog post, Facebook said it collaborated with five "leading banks" on its latest payment service: ICICI Bank, HDFC Bank , Axis Bank, State Bank of India, and Jio Payments Bank. UPI is funded by more than 160 banks.