Tension between the United States and China, Coronavirus would push the technical supply chain to evolve

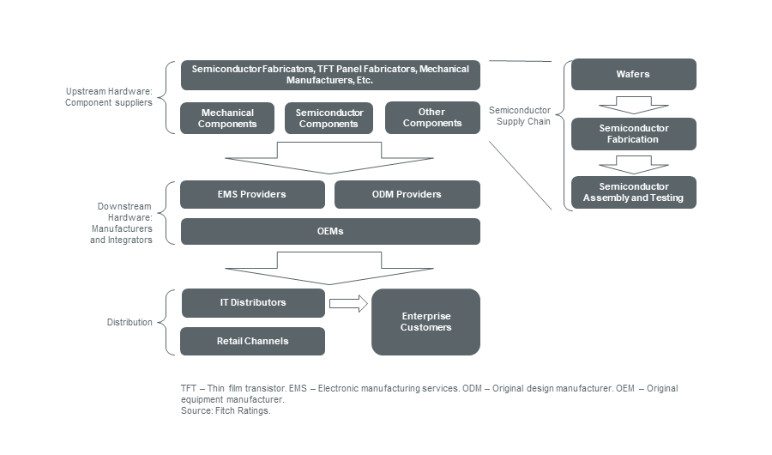

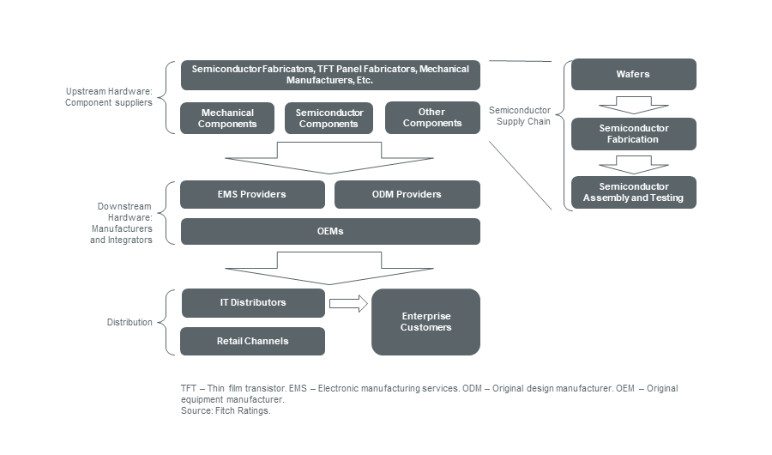

The escalation of tension in the US-China and production challenges driven by coronavirus will force supply chains in the US technology to evolve over time. Changes in the supply chain leading to less dependence on China and greater US production of core semiconductor components could have significant credit implications for the industry. Costs would rise, and substantial capital investment would be required with returns delayed due to the time needed to build infrastructure and accumulate intellectual capacity. Increased upstream component production in North America could also result in more downstream hardware assembly on the continent that would enhance US control over the entire tech supply chain.

The reliance of US technology on a global supplier network, many of which have suffered manufacturing disruption due to coronavirus, exposes issuers to trade and financial risks. Global trade disputes are significant headwinds for the industry, owing partly to US national security issues and economic downturn triggered by the pandemic. Increased domestic production of the more advanced components could act as a cover for geopolitical risks.

Last week, the US announced a new export restriction on Chinese telecom equipment manufacturer Huawei that further limits the ability of top semiconductor companies to deliver Huawei without a US licence. Huawei, which remains on the US Entity List, has shifted some orders to SMIC, a semiconductor manufacturer backed by the Chinese government, but SMIC lacks the technical prowess and capability to advance Huawei's growth strategy.

Last week, Taiwan Semiconductor (TSMC) announced that it intends to develop and operate an advanced semiconductor fab in Arizona with the shared understanding and dedication of US government support. The announcement followed media reports that the Trump administration was working with technology firms, including Intel (A+/Stable) and TSMC, to improve domestic semiconductor development, the primary building block for technology hardware.

We see the US-TSMC partnership as a first step in creating a more independent U.S. supply chain of technology, given the high entry barriers, specifically related to the substantial capital and design capabilities needed for leading-edge semiconductor manufacturing. In partnering with TSMC, US chipmakers won't face the financial pressure of incremental investment that could impact credit profiles negatively. Additionally, producing more upstream components will give the US greater influence over the supply of semiconductors when national security concerns arise.

Intel has lagged behind in the production of seven nanomenter (7 nm) and five nanometer (5 nm) chips of the next generation, while GlobalFoundries made a strategic decision at the end of 2018 to suspend its 7 nm program due to the significant cost of competing. Samsung (AA-/Stable) has invested tens of billions of dollars and developed years of experience in technical design to keep up with advances in chips.

TSMC holds a leading position in next-generation chips, similar to Samsung. The new facility of the company , based in Arizona, will use its state-of-the-art 5 nm technology that surpasses US companies such as Intel and will have a capacity of 20,000 wafers per month (wpm) compared to about 50,000wpm–55,000wpm at its Taiwan-based facilities. Phoenix, AZ has a semiconductor ecosystem that includes semiconductor packaging and testing firms that help complete the U.S. semiconductor ecosystem to market products manufactured in the U.S.

TSMC will spend $12 billion to build the facility over nine years, with production not beginning until 2024. Given its strategic importance to the Trump administration, we anticipate US support could include tax incentives. The investment represents only 8 per cent of the $16 billion in capex budget for the company in 2020, assuming that TSMC allocates the cost evenly over nine years. TSMC also operates a fab in Washington State and has a design center in Texas and California but plans a second production plant to further improve its relationship with the United States.