Opportunities in developing countries by cryptocurrency

Without crypto currencies, the local fiat currency often has to be exchanged for larger fiat currencies, such as the US dollar or the Euro, and then reverted to the target currency, as there is often no liquid market for the exchange of the fiat currency into the target fiat currency. This method could be streamlined by cryptocurrencies, which could make it quicker and cheaper (Ammous, 2015).

For example, a Chicago-based Indian worker could use a local service provider that transfers US dollars to Bitcoins to transfer money to a family member in India, where the family can then deduct Rupees from a local service provider that changes Bitcoins to Rupees. This would make Western Union firms hesitate to do so. However, it is essential to have a liquid market for Bitcoin to the US dollar and Rupee to increase efficiency. In order to create a liquid market for Bitcoins, a number of start-ups have been set up, such as BitPesa in Kenya, which provide liquid markets for specific currency corridors, e.g. for the direct exchange of Kenyan Shilling to the US dollar.

In fact, Crypto currencies could address the question of participating in foreign trade without needing a bank account. Crypto currencies like Bitcoin may help individuals and businesses promote small-scale international trade. Using Bitcoins allows such parties to sell goods in return for Bitcoin, thus eliminating conventional e-commerce schemes (Scott, 2016), which sometimes require having to set up a vendor account with a formal bank.

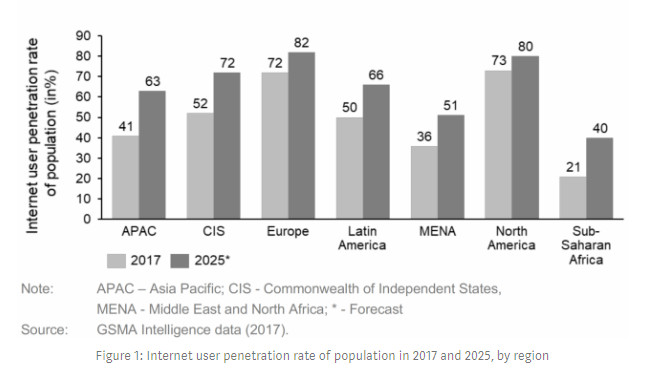

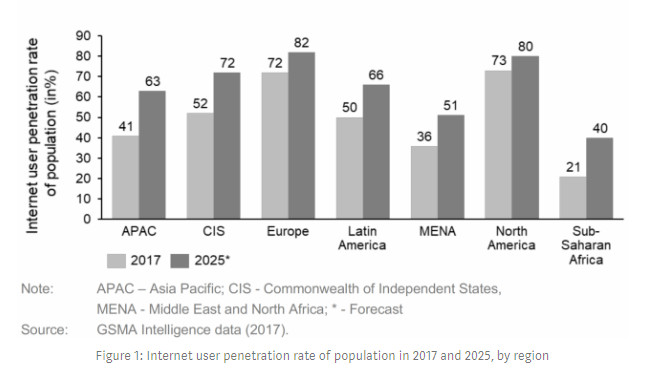

Another way in which crypto currencies might help increase financial inclusion in developing countries is to act as a quasi-bank account, as anyone with internet access can download a Bitcoin wallet (Honohan, 2008). This wallet can then be used as a quasi-bank account where people can make deposits and purchases on a regular basis (Scott, 2016).

Decreased transaction costs may also increase the likelihood of microcredits, as money transactions currently face high costs. The reduction of these costs would open up tremendous opportunities for foreign financing. Use crypto currencies enables individuals in more developed countries to make small money transfers to citizens in developing countries. This transaction could be for a small amount of money, but could change the life of an individual in a developing country.

These microfinance loans are actually costly because borrowing and repaying loans are subject to transaction fees that are almost as high as the payment itself. Nevertheless, as transaction costs are significantly reduced or even eliminated, such loans may become more common (Ammous, 2015).

In addition, crypto currencies, primarily in combination with smart contracts, can contribute to strengthening social trust and fighting corruption through a more transparent contract system. Citizens can use publicly available crypto currency data in the blockchain to monitor how state funds are used. It will also help governments to better track their expenditures and increase their budget allocation (Schmidt Kai Uwe, 2017).