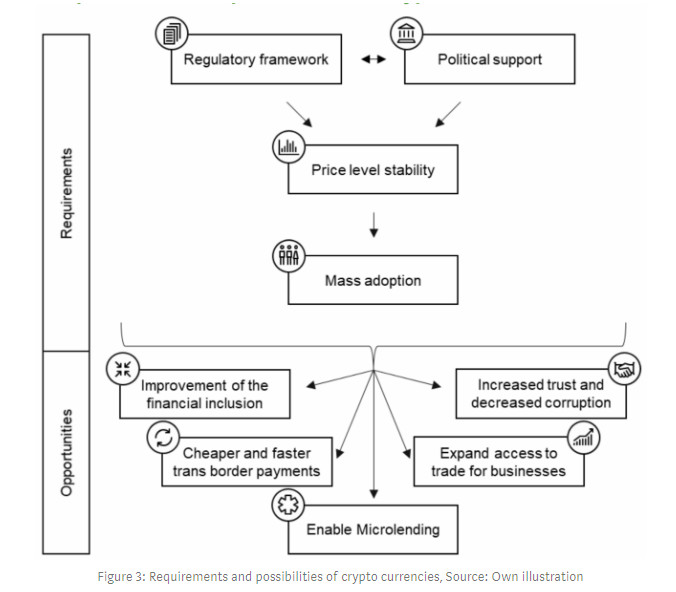

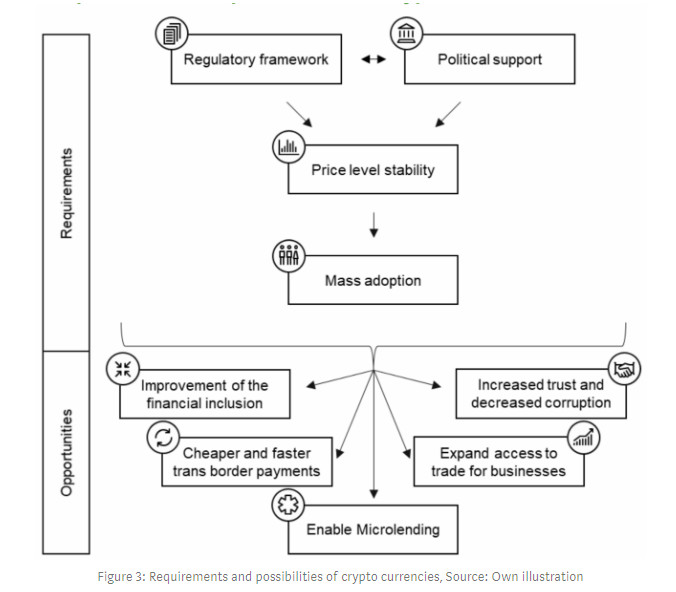

Crypto currencies will have a huge effect on developed countries by increasing the financial inclusion of individuals and businesses. In particular, cross-border payments can be strengthened by reducing transaction fees and time. This is beneficial for remittance payments, peer-to - peer loans and international trade. The underlying technology also supports the fight against corruption by providing a more transparent tracking system for the use of funds.

However, all of these benefits are heavily dependent on the mass adoption of crypto currencies and the fulfillment of all three functions of money, and this is not currently the case due to excessive price volatility. The lack of back-up and centralisation does not help a stable price level .

Stable price rates could be achieved by tighter enforcement and more government support for crypto currencies. However, crypto currencies can only receive political support if the government or central banks have control over the money supply. Nonetheless, this will reduce many of the advantages that crypto currencies provide.

Today, crypto currencies help the cycle of developed countries' development in very restricted ways. Future developments are heavily dependent on the regulations to be introduced, the resulting price stability and the adoption of cryptocurrency.

Limitations and other potential cryptocurrency areas

Cross-border payments are actually the most important use of crypto currencies due to reduced processing time and costs. The Libra project, introduced by Facebook, also aims to substantially reduce cross-border payment fees by using blockchain technology. Currently, digital currencies are primarily used for cross-border payments.

However, the importance of cross-border payments could be overtaken in the future by peer-to - peer lending across an even wider market, as peer-to - peer lending helps solve liquidity problems, particularly in developing countries.

In addition, the issue of collateralisation could be partially resolved by community trust. Internal processes in major corporations or governments may be another area of concern for crypto currencies. This would be a promising application, because it would increase the credibility to a level that current tracking systems can not provide.

A particular case where Ethereum may be useful is the case of smart contracts, as crypto currencies are required to execute smart contracts as an incentive model so that other people can run blockchains and the underlying infrastructure.

Actually, Ether's crypto currency is often used to pay for these services. There are several applications focused on smart contracts, and for this reason, these contracts are a key factor in the potential use of crypto currencies.